Few questions to me seem as pressing as “what causes economic crises”, “what policies and institutions best mitigate the severity of crises”, or “what are the political antecedents and consequences of crises?”. Much of my research explores these very questions, probing a range of comparative and international factors along both economic and political dimensions.

The Economic Consequences of Banking Crises: The Role of Central Banks and Optimal Independence

The American Political Science Review, Volume 116, Issue 2

Abstract

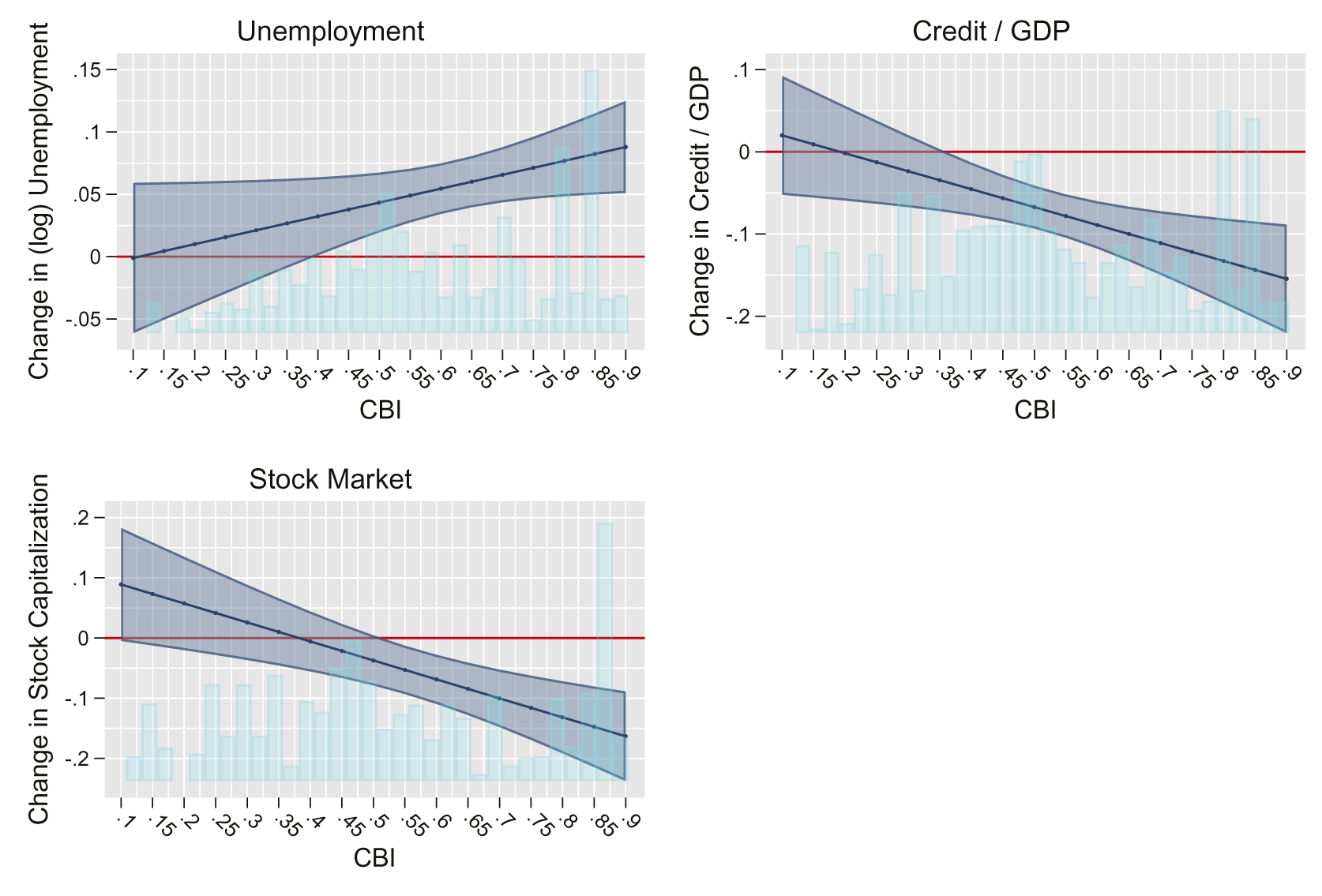

A large literature establishes the benefits of central bank independence, yet very few have shown directly negative economic consequences. Furthermore, while prevailing monetary theory suggests CBI should enhance management of economic distress, I argue that independent central banks exhibit tepid responsiveness to banking instability due to a myopic focus on inflation. I show that banking crises produce larger unemployment shocks and credit and stock market contractions when the level of central bank independence is high. Further, I show that these significant economic costs are mitigated when central banks do not have the inflation-centric policy mandates predominantly considered necessary. When the bank has high operational and political independence, banks’ whose policy mandate does not rigidly prioritize inflation produce significantly better outcomes during banking crises. At the same time, I show that this configuration does not produce higher inflation, suggesting it achieves a more flexible design without incurring significant costs.

The democratic (dis)advantage: The conditional impact of democracy on credit risk and sovereign default

Economics & Politics, Early View

Abstract

Many have argued that democracies are able to make credible commitments to repay their debts and consequently enjoy higher sovereign credit ratings. In contrast to this expectation, I argue that the advantage of democracies in credit ratings is conditional on the countries' level of financial vulnerability and adjustment needs. Because democracies have more diffuse decision-making and are more accountable to the public, they encounter greater difficulty than autocracies in passing unpopular economic adjustment measures. Thus, I argue that democracies with high debt levels and low foreign reserve assets experience worse credit outcomes, whereas democracies with low vulnerability experience more positive outcomes. In a sample of up to 96 developing countries, I show that democracies have worse credit ratings and CDS Spreads and are more likely to default than their autocratic counterparts when foreign reserves are low relative to external debt. Notably, I also show that large debt burdens increase credit risk mainly in more democratic countries. I further test the causal pathway of the democratic advantage by constructing democracy scores of “market-friendly” and “adjustment-difficulty” democracy, finding that democracy worsens debt outcomes due to adjustment difficulty. These findings help to revise and clarify the causal logic surrounding the democratic advantage hypothesis.

The effectiveness of fiscal institutions: International financial flogging or domestic constraint?

European Journal of Political Economy, Volume 64

Many have argued that financial markets are crucial in ensuring that governments maintain sustainable fiscal balances - the so called ‘market discipline hypothesis’. A recent version of this theory holds that both fiscal rules and fiscal transparency are necessary to enable markets to discipline overspending governments. I argue, however, that while these fiscal institutions are effective at improving governments fiscal balances, financial markets are likely not the causal mechanism which discipline governments’ fiscal policies. Instead, I propose that fiscal rules and transparency promote better budget balances because domestic political actors use fiscal institutions to constrain executive policymaking. I test these competing hypotheses of why these fiscal institutions are effective – financial markets vs political competition – and find that country budget balances are increased not as a consequence of financial markets, but when the level of political competition and civil society engagement is sufficiently high. These results are robust to accounting for the possible selection bias of who adopts fiscal institutions.

Additional Work

In other work, I broaden the scope of the economic management problem arising from independent central banks and inflation mandates. Is it only during banking crises that this institutional design impairs economic management, or is it a wider problem? I also show that this institutional design leads to excessive swings in unemployment rates during normal business cycles, and trace this effect from monetary policy. I further examine how monetary policy deals with credit booms under the regime of CBI. This is important because, on the one hand, tighter monetary policy could possibly enhance asset quality during credit booms, leading to higher stability. On the other hand, if tighter policy is mistimed and deployed too late in a credit boom, it may simply spark the onset of instability. In another paper, I examine the political consequences of central bank independence. If CBI generates potentially adverse economic consequences, does this generate political aftershocks? In another paper, I argue that the negative amplification effects arising from CBI does in fact lead to political instability.